Why We Must Prioritise Export-Led Labour-Intensive Manufacturing to Create Jobs

In Summary

To ensure fast economic growth, India needs to shift focus to exports.

- On a per capita basis, India has a very small domestic market compared to global markets.

- Countries that have achieved fast and sustained growth in the last 70 years have done it by export-led growth.

Exports are driven by comparative advantage. For India, that advantage is labour.

- India has a gigantic low-skilled labour pool with very low-productivity job options.

- Our education systems are not producing high-skilled labour at fast enough rates to depend on high skilled options.

China is gradually vacating its position in labour-intensive sectors.

- Clothing, footwear, light manufacturing are all labour-intensive spaces in which China is becoming less competitive.

- Vietnam and Bangladesh have made the most of this opportunity by filling in and accelerating their economies. It is time India steps in.

Read further to explore each point in detail

Why Exports are Essential for India to Achieve Multifold Growth

India’s domestic market is not large enough market for Indian-produced goods

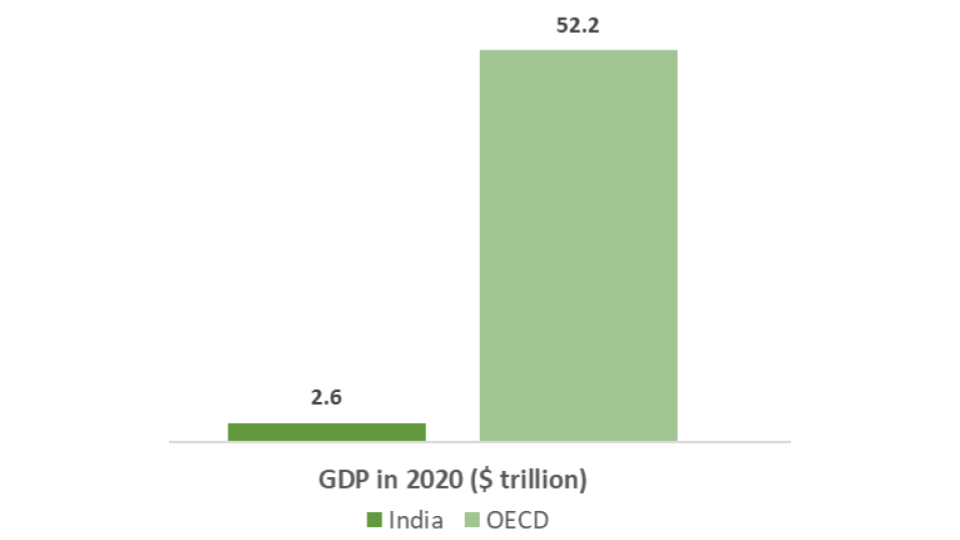

On a per capita basis, India has a very small domestic market compared to global markets. The OECD has the same population as India, but 20 times the GDP. While India’s domestic clothing market is worth USD 55 Billion, OECD’s clothing imports amount to USD 380 Billion. By simply capturing half of China’s apparel exports, India will be able to double its domestic apparel market.

China, Japan, Korea, Taiwan’s Growth Has Been Driven By Exports

Every country that has grown rapidly in the last 70 years, like Japan, Taiwan, South Korea, and China has done it via exports. Even India’s fast growth was led by IT services exports!

Why India Should Capitalise on Its Large Labour Pool to Drive Export-Led Growth

India’s greatest comparative advantage is labour

India’s labour supply for high-skilled manufacturing and services like IT is relatively small and limited, due to deep-rooted issues in our education systems, and it will take a long time for a significant number of high-skilled workers to meaningfully change the situation. On the other hand, we have an extremely large low-skilled labour pool with mostly low-productivity job options. For labour-intensive manufacturing this is an advantage, not a constraint.

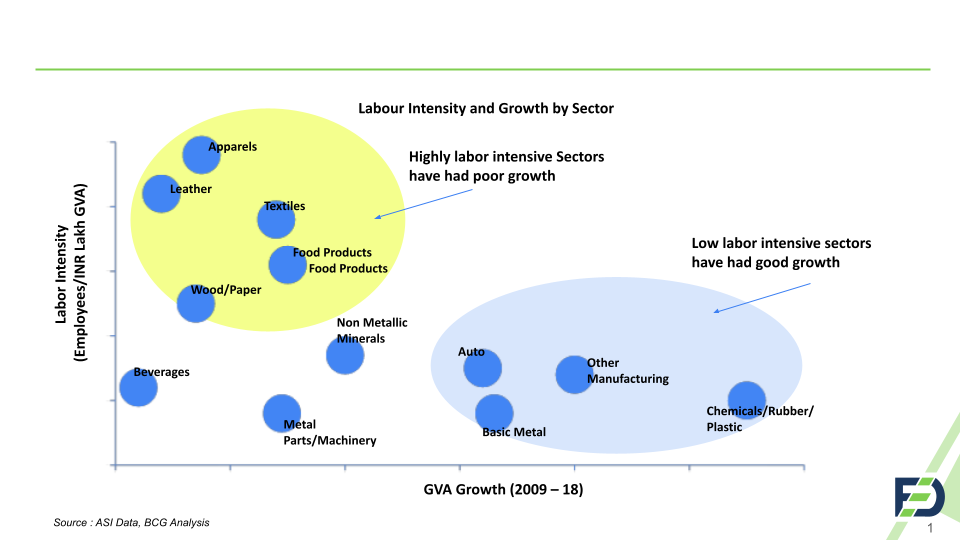

High- skill and low labour intensity manufacturing sectors have paradoxically grown faster but have offered limited employment opportunities to low-skilled labour.

China is gradually vacating its position in labour-intensive sectors

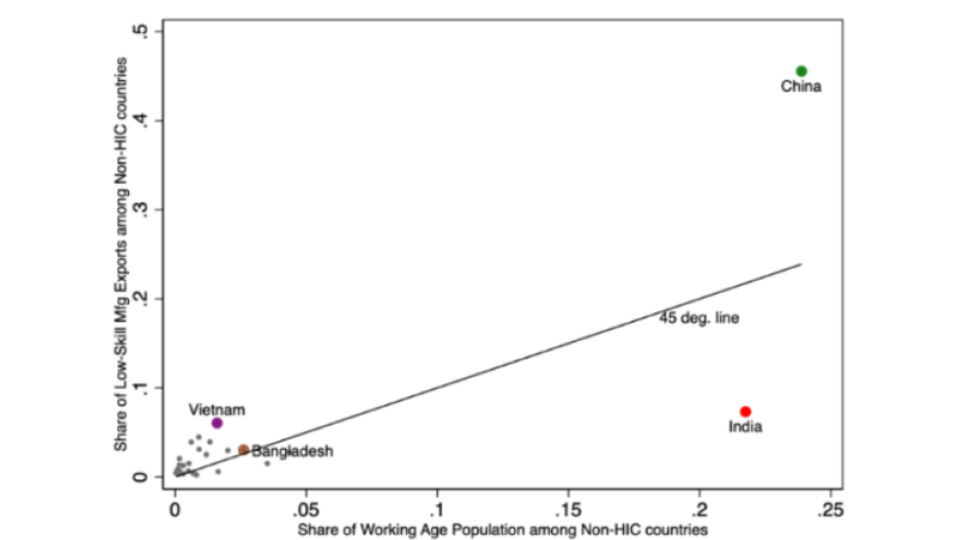

China is becoming less competitive in labour-intensive sectors like garments, footwear, and light manufacturing. Vietnam and Bangladesh have made the most of this opportunity by increasing exports in these areas and accelerating their economies. It is time India steps in. So far India has been punching below its weight in low-skill, labour-intensive sectors, and the consequent gains go to China and Vietnam. For example, India’s missing production in the low-skill textiles and clothing amounts to $140 billion, which is about 5% of India’s GDP.

This may be India’s last chance to take utilise the export-led springboard for broad-based growth

The gap left by the decrease in Chinese labour-intensive exports is being filled by Bangladesh and Taiwan. China is maye be becoming less competitive but in 20 years so will India.

The country is at the cusp of demographic transition. The cohort of children (0-10 years) is smaller relative to young adults (10-20 years) and our workforce will start reducing in 20 years. This could be India’s last chance to utilise the export-led springboard for broad-based growth.

India is Punching Below Its Weight in Low-Skill, Labour-Intensive Sectors

High- skill and low labour intensity manufacturing sectors have paradoxically grown faster but have offered limited employment opportunities to low-skilled labour. India has severely underperformed in low-skilled exports manufacturing relative to our working age population size.

‘Missing’ exports in low -skilled sectors where India is punching significantly below its weight. The consequent gains go to China and Vietnam. For example, India’s missing production in the low-skill textiles and clothing amounts to $140 billion, which is about 5% of India’s GDP.

What are the Roadblocks That Continue to Hinder Manufacturing Growth

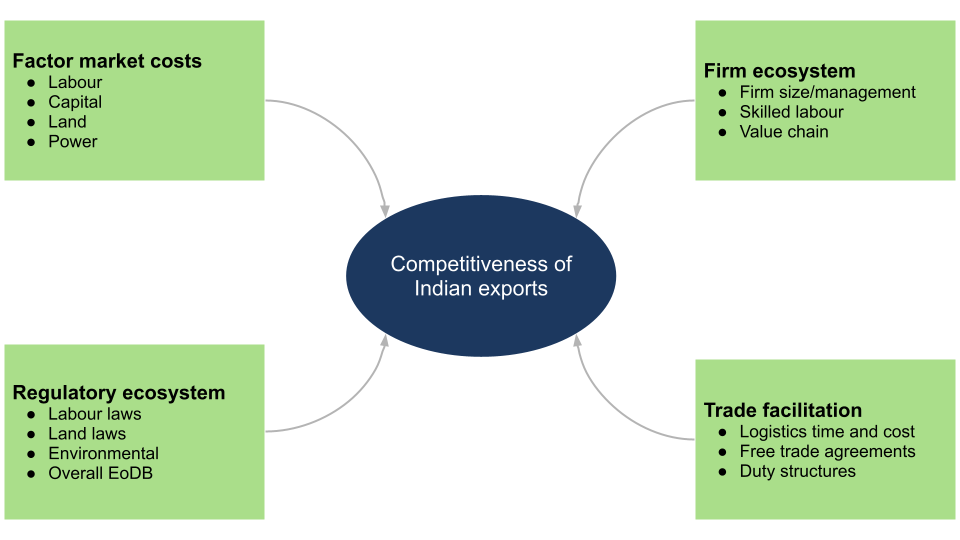

While the government has implemented many reforms to promote manufacturing, significant gaps continue to exist on critical dimensions. Ecosystem competitiveness in exports is a key fundamental driver. Incentive schemes will be most useful only if we fix the fundamentals.

5 Key Barriers to Realising the Growth Potential in Garments Manufacturing

- Ease of Doing Business

Compliance burden in manufacturing continues to deter new global and local players from entering and existing ones from expanding

- Labour regulations & productivity

Labour productivity in India is lower than competition mainly due to restrictions around fixed term hiring, shop-floor flexibility, overtime limits and minimum wage

- Business Ecosystem

Historical evolution of industry in a subscale and fragmented manner prevents it from reaping cost benefit of a scale and concentrated ecosystem

- FTA Disadvantage

Key competitors in the region (Bangladesh, Pakistan, Sri Lanka) enjoy FTA advantage of about 9% against India in European market

- Raw Material Competitiveness

India loses out on garments made from synthetic fibres which account for 70% of market due to historical disadvantage in MMF fabric driven by high duties

FED’s Recommended Solutions to Achieve Growth in Garment Manufacturing

- Mega Textile and Garments clusters must include business- friendly, fast track governance structure

- Employment friendly concessions on labour regulations in Mega clusters

- Aggressive outreach to global players which bring management of scale and technology

- Rapid conclusion of FTA negotiations and duty rationalisation on MMF

In 10 years, FED aims to facilitate ~20% growth per year in export-led, labour-intensive manufacturing in India.

Learn more about Our Approach